< prevnext >

Article:

Chicago Tax Appraisal Analysis - South Cook County Suburbs Most Likely To Be Over Assessed

Cook County Tax Appraisals has long taken the position that Chicago's high tax rate communities, particularly in the south suburbs are often being over appraised and over assessed. As Chicago tax appraisers we were concerned about the difficulty in quantifying these over assessment.

In a recent study we completed of industrial building sales in the Chicago south suburban Cook County market from 2011 through 2014, we found that there were few sales in high tax rate cities and most sales in lower tax rate cities. The median property tax rate of the buildings sold was only 11.72% and only four arm's-length sales were uncovered where the real estate tax rate was over 15%. Appraisers and the assessor is often forced to use sales in low tax areas (since there are almost no sales in high tax areas) but applies them to high tax subject properties without adequately adjusting for the tax rate differentials. We have found that there should be about a 3% value drop for every 1% increase in real estate taxes. We also almost never see any Chicago commercial appraisers adequately adjusting for these differentials.

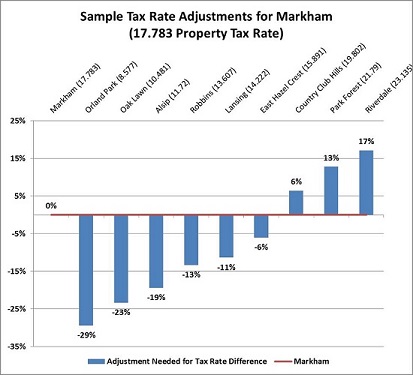

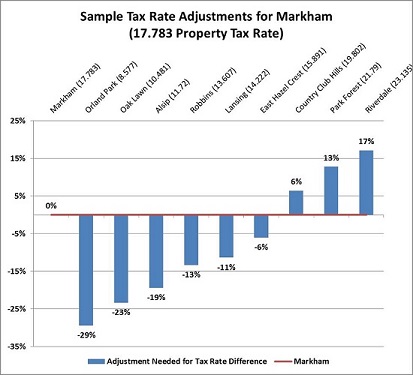

By doing a loaded capitalization rate adjustment on every comparable we can demonstrate (see Markham example above) that there is roughly a 3% decline in value for every 1% increase in the real estate tax rate. Lansing’s tax rate is 14.222% or 3.56% less than Markham’s and would require an 11% downward adjustment (a rounded 3.10% value drop per 1% tax rate change). An Oak Lawn comparable (10.481% tax rate) has a 7.3% lower tax rate than Markham and would require a 23% downward adjustment which also reflects a similar near 3% decline for every 1% differential in real estate taxes.

If the subject property has a tax rate over 15%, a tax rate differential quantitative analysis should be mandatory. Property values could be dramatically lower (10-30%) or more if tax rate differentials are adequately adjusted for. Cook County Tax Appraisals is the only Chicago area appraisal firm we are aware of that provides comprehensive quantitative support for such factors. Analyzing every comparable is a very time consuming process. Cook County Tax Appraisals has developed computer models to facilitate this process. Most Chicago area appraisers are simply not mathematically adjusting for this factor and thus over appraising these properties.

Below is the scheduled release of townships in the next few months and the tax rates in those communities. We strongly urge you to have a commercial tax appraiser complete a loaded capitalization rate analysis done on any communities with tax rates of 15% or more. The communities listed below in bold are the highest tax rate areas with the greatest likelihood of assessor and commercial appraiser over valuation. Of course even assessments in communities with tax rates should be reviewed if the tax rates are under 15% as the mass appraisal process, while good, can often yield errors.

Communities in bold are a few of the high tax rate areas with the highest risk of over assessment and over appraisal. A quantitative loaded tax rate analysis could often warrant a 10-30% adjustment for this factor alone. This analysis can even be applied to limited appraisals where no income approach is applied.

In a recent study we completed of industrial building sales in the Chicago south suburban Cook County market from 2011 through 2014, we found that there were few sales in high tax rate cities and most sales in lower tax rate cities. The median property tax rate of the buildings sold was only 11.72% and only four arm's-length sales were uncovered where the real estate tax rate was over 15%. Appraisers and the assessor is often forced to use sales in low tax areas (since there are almost no sales in high tax areas) but applies them to high tax subject properties without adequately adjusting for the tax rate differentials. We have found that there should be about a 3% value drop for every 1% increase in real estate taxes. We also almost never see any Chicago commercial appraisers adequately adjusting for these differentials.

By doing a loaded capitalization rate adjustment on every comparable we can demonstrate (see Markham example above) that there is roughly a 3% decline in value for every 1% increase in the real estate tax rate. Lansing’s tax rate is 14.222% or 3.56% less than Markham’s and would require an 11% downward adjustment (a rounded 3.10% value drop per 1% tax rate change). An Oak Lawn comparable (10.481% tax rate) has a 7.3% lower tax rate than Markham and would require a 23% downward adjustment which also reflects a similar near 3% decline for every 1% differential in real estate taxes.

If the subject property has a tax rate over 15%, a tax rate differential quantitative analysis should be mandatory. Property values could be dramatically lower (10-30%) or more if tax rate differentials are adequately adjusted for. Cook County Tax Appraisals is the only Chicago area appraisal firm we are aware of that provides comprehensive quantitative support for such factors. Analyzing every comparable is a very time consuming process. Cook County Tax Appraisals has developed computer models to facilitate this process. Most Chicago area appraisers are simply not mathematically adjusting for this factor and thus over appraising these properties.

Below is the scheduled release of townships in the next few months and the tax rates in those communities. We strongly urge you to have a commercial tax appraiser complete a loaded capitalization rate analysis done on any communities with tax rates of 15% or more. The communities listed below in bold are the highest tax rate areas with the greatest likelihood of assessor and commercial appraiser over valuation. Of course even assessments in communities with tax rates should be reviewed if the tax rates are under 15% as the mass appraisal process, while good, can often yield errors.

| Riverside Township (2/7/2014 mailing) | Tax Rate |

| Brookfield | 10.410-13.354 |

| Lyons | 11.396-14.080 |

| North Riverside | 8.350-9.679 |

| Riverside | 10.947-10.958 |

| River Forest Township (2/11/2014 mailing) | Tax Rate |

| River Forest | 10.222 |

| Bremen Township (3/7/2014 mailing) | Tax Rate |

| Oak Forest | 11.374-13.114 |

| Midlothian | 12.377-12.452 |

| Robbins | 13.607-15.227 |

| Posen | 11.596-15.497 |

| Markham | 17.783-22.034 |

| Hazel Crest | 16.411-19.371 |

| Country Club Hills | 19.802-21.123 |

| Tinley Park | 10.451-15.775 |

| Cicero Township (3/20/2014 mailing) | Tax Rate |

| Cicero | 14.038-14.318 |

Communities in bold are a few of the high tax rate areas with the highest risk of over assessment and over appraisal. A quantitative loaded tax rate analysis could often warrant a 10-30% adjustment for this factor alone. This analysis can even be applied to limited appraisals where no income approach is applied.