<<< back< prevnext >

Article:

2014 Industrial Market Market Conditions - South Cook County

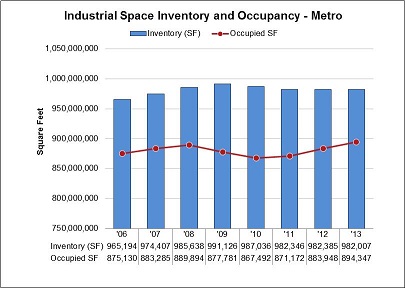

Taken as a whole, Chicago metropolitan area industrial market appears to be showing renewed signs of life with higher transaction volumes, positive absorption levels and an improvement in occupancy levels. While rental rates have remained flat, historically low interest rates are allowing for a compression of capitalization rates, which is supporting prices – at least until the rates go back up.

For purposes of Chicago Commercial Tax Appraisal a more nuanced view is required. The modest improvements we are seeing are "lumpy," and are certainly not being experienced universally across the entire metropolitan marketplace. In many parts of the south suburban industrial market we continue to see negative absorption, flat rental rates, flat occupancy levels and virtually no new development.

The charts below compare the Chicago industrial market conditions for the metropolitan area as a whole (left) with the 29 high tax south suburban communities having composite property tax rates 14% and above (right).

The high property tax communities in our analysis include: Bellwood, Burnham, Calumet City, Calumet Park, Chicago Heights, Cicero, Country Club Hills, Dixmoor, Dolton, East Hazelcrest, Flossmoor, Ford Heights, Glenwood, Harvey, Hazelcrest, Homewood, Lansing, Markham, Matteson, Maywood, Olympia Fields, Park Forest, Phoenix, Richton Park, Riverdale, Sauk Village, South Holland, Stone Park, and Thornton.

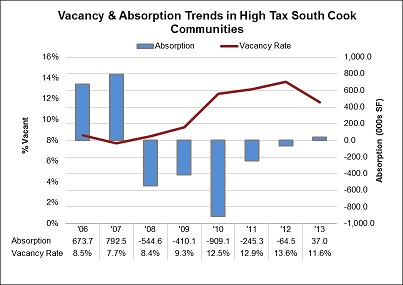

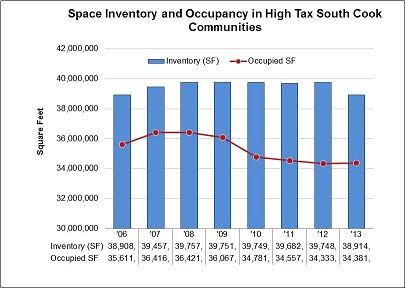

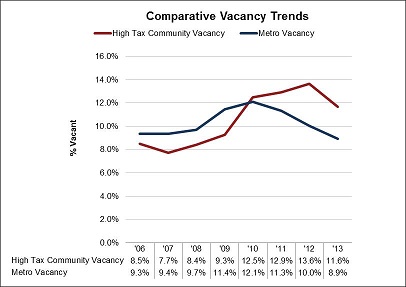

The industrial absorption rates show positive movement since 2011 for the overall Chicago metropolitan market. The high property tax communities in the South Suburban market; however, have shown strong negative absorption since 2008 and is now virtually at a break even. While vacancy rates declined from 13.6% to 11.6%, the reason is not due to strength in the market but because the available inventory declined as industrial buildings are being removed from the inventory without being replaced.

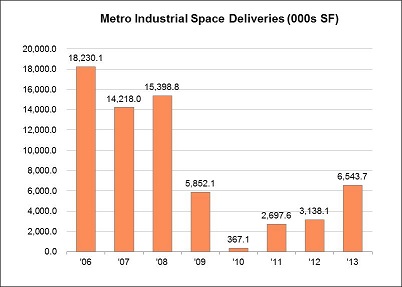

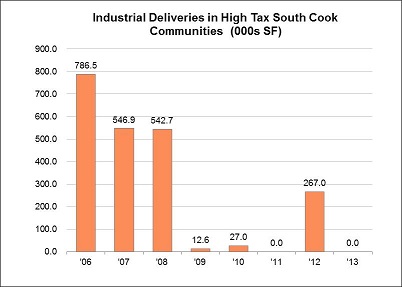

Industrial deliveries (typically built-to-suit) have started recovering to some degree in the overall market since 2010. By contrast there was no new industrial development in these south suburban communities at all in 2011 or 2013. Developers see almost no opportunity for new construction when asking prices are so far below construction costs. Colliers International reports that the average asking price for an industrial building in the Chicago Metropolitan Area is $45.31 versus only $23.86 in the south suburbs, which is 47% below the metropolitan area average. Even these rock bottom prices, however, seem unable to attract many buyers.

During field inspections, our commercial property tax appraisers are continually hearing about the crushing property tax bills in these areas from property owners. The extraordinarily high property tax rates of these communities appear to negate the low prices and create unacceptable levels of risk for most investors or business owners.

Our feeble industrial market recovery appears to be bypassing these higher property tax south suburban communities. It is important that Chicago area commercial real estate appraisers recognize the profound impact that higher property taxes can have on value and the overall health of the community.

For purposes of Chicago Commercial Tax Appraisal a more nuanced view is required. The modest improvements we are seeing are "lumpy," and are certainly not being experienced universally across the entire metropolitan marketplace. In many parts of the south suburban industrial market we continue to see negative absorption, flat rental rates, flat occupancy levels and virtually no new development.

The charts below compare the Chicago industrial market conditions for the metropolitan area as a whole (left) with the 29 high tax south suburban communities having composite property tax rates 14% and above (right).

| METRO INDUSTRIAL MARKET | HIGH TAX RATE COMMUNITIES |

| | |

| | |

| CoStar Inc., data | |

The high property tax communities in our analysis include: Bellwood, Burnham, Calumet City, Calumet Park, Chicago Heights, Cicero, Country Club Hills, Dixmoor, Dolton, East Hazelcrest, Flossmoor, Ford Heights, Glenwood, Harvey, Hazelcrest, Homewood, Lansing, Markham, Matteson, Maywood, Olympia Fields, Park Forest, Phoenix, Richton Park, Riverdale, Sauk Village, South Holland, Stone Park, and Thornton.

The industrial absorption rates show positive movement since 2011 for the overall Chicago metropolitan market. The high property tax communities in the South Suburban market; however, have shown strong negative absorption since 2008 and is now virtually at a break even. While vacancy rates declined from 13.6% to 11.6%, the reason is not due to strength in the market but because the available inventory declined as industrial buildings are being removed from the inventory without being replaced.

MORE CHARTS COMPARING CHICAGO AREA INDUSTRIAL MARKET DATA

| | |

| | |

| CoStar Inc., data | |

Industrial deliveries (typically built-to-suit) have started recovering to some degree in the overall market since 2010. By contrast there was no new industrial development in these south suburban communities at all in 2011 or 2013. Developers see almost no opportunity for new construction when asking prices are so far below construction costs. Colliers International reports that the average asking price for an industrial building in the Chicago Metropolitan Area is $45.31 versus only $23.86 in the south suburbs, which is 47% below the metropolitan area average. Even these rock bottom prices, however, seem unable to attract many buyers.

During field inspections, our commercial property tax appraisers are continually hearing about the crushing property tax bills in these areas from property owners. The extraordinarily high property tax rates of these communities appear to negate the low prices and create unacceptable levels of risk for most investors or business owners.

Our feeble industrial market recovery appears to be bypassing these higher property tax south suburban communities. It is important that Chicago area commercial real estate appraisers recognize the profound impact that higher property taxes can have on value and the overall health of the community.